CROSS BORDER FOREX PAYMENT SPECIALISTS

There was absolute carnage in the Rand as it nose dived, like a runaway train. The Rand hit a new all time low, as the United States Ambassador to South Africa openly claimed South Africa had supplied Russia Arms on the clandestine visit of the sanctioned Russian ship [Lady R] visited the South African naval base Simonstown. Add rolling stage 6 blackouts and the country stands to lose out on the AGOA agreement on free trade to the United States. Turmoil or the PERFECT STORM!! The AGOA agreement is up for review in 2025.

The South African president Cyril Ramaphosa did not install confidence in his reply on the subject as he begged law makers to give the process room to investigate the arms supply claims. To be fair, this only happened 6 months ago.

The Presidency said it was disappointed the United States (US) did not abide by an agreement to wait for the outcome of an investigation into why a Russian vessel docked at the Simon’s Town naval base in Cape Town in December last year.

Ramaphosa’s spokesperson, Vincent Magwenya, released a much-awaited statement on Thursday night in the wake of claims by the US Ambassador to South Africa, Reuben Brigety, that South Africa provided arms to Russia via the Lady R vessel.

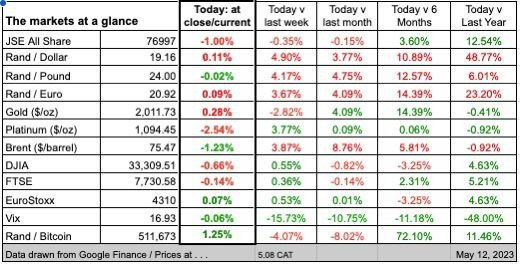

At 05:30, the US dollar is trading 0.1% lower against the South African rand at R19.1793, while the euro is trading marginally lower at R20.9520. At 05:30, the British pound has gained 0.1% against the South African rand to trade at R24.0186.

The anti-risk US Dollar and Japanese Yen outperformed their major counterparts on Thursday as haven demand boosted their appeal. Meanwhile, the sentiment-linked Australian and New Zealand Dollars underperformed. The DXY Dollar Index gained 0.64% over the past 24 hours, clocking in the best day since March 15th.

Last week, it was revealed that 264k jobless claims were filed in the United States. That was the highest outcome since October 2021, representing a 9% increase compared to the previous reading. This is an early sign that the labor market could be showing signs of cracking after remaining persistently tight despite aggressive monetary policy

Resistance levels:

- 19.5000

- 19.3453

Support levels:

- 19.0000

- 18.7167

- 18.5000

Bank of England surprised practically no one today by choosing to lift its policy rate by 25bps to 4.50%. Markets went into the meeting with 25bps priced in and all but one of the 48 economists surveyed by Bloomberg had projected a quarter-point move.

Elon Musk said Thursday, he has found a new CEO for Twitter, or X Corp. as it’s now called and it’s a woman. He did not name her, but said she will be starting in about six weeks. Musk, who bought Twitter last fall and has been running it since, has long insisted he is not the company’s permanent CEO. The Tesla billionaire said in a tweet Thursday, that his role will transition to being Twitter’s executive chairman and chief technology officer.

Locally, FNB is facing a lawsuit of R50m in damages and Godrich Gardee Attorneys will recover the R4b from FNB on behalf of 32 000 black low cost housing Clients. It has now transpired , that FNB lied under oath that the interest on mortgage was not linked to prime to cover up discrimination.

Have a safe weekend, where will the Rand be when we open Mondays report?