These are the mid rates at 6:15 today:

| USD = R17.81 | AUD = R11.99 |

| GBP = R22.12 | DXY = 102.14 |

| EUR = R19.45 | Brent Crude = $78.61 per barrel |

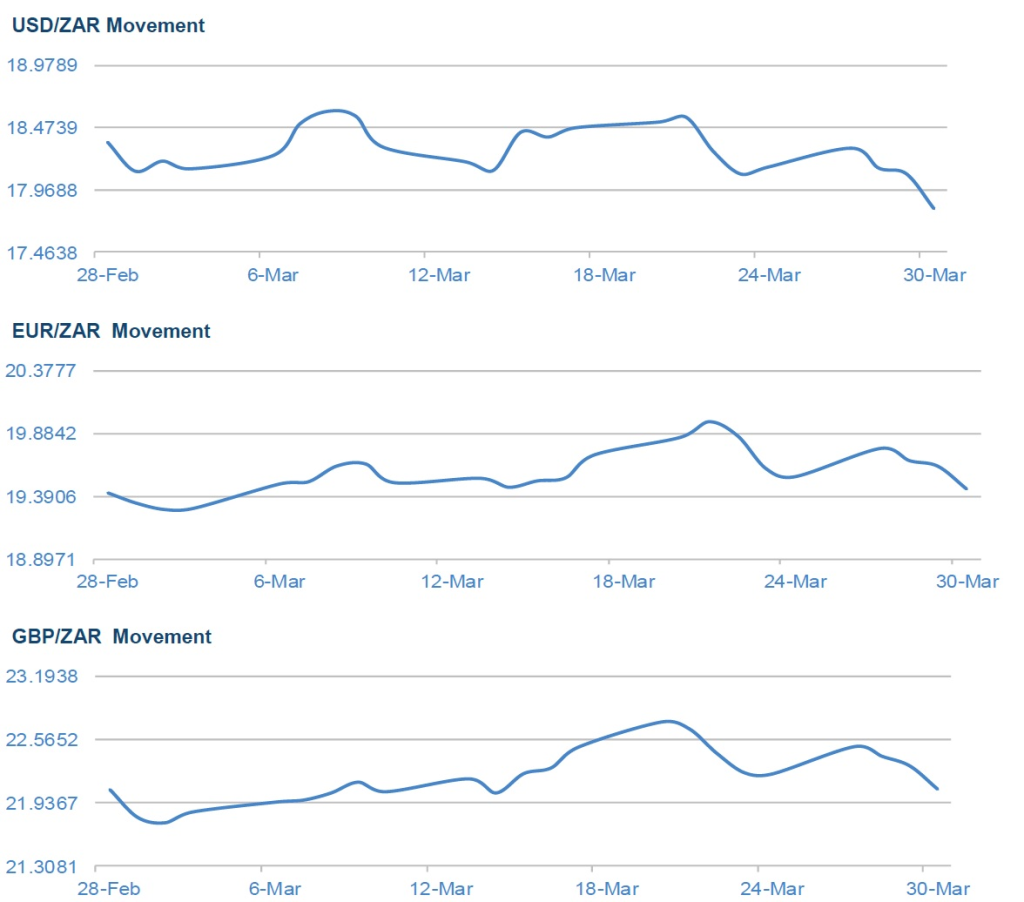

Local headlines have struggled to improve the Rand lately but not yesterday, this as the SARB’s announcement had a clear and dramatic impact on our exchange rate. The day was already going well as we opened at R18.14 to the Dollar and strengthened to R18.03 by the afternoon session, but our interest rate announcement sent the Rand rocketing to R17.77 with us pretty much holding onto those gains since.

Inflation around the world is coming down from it’s 2022 peak, although in some countries it’s proving stickier than the authorities would like. In SA however our inflation rate ticked up at the last reading going from 6.9% to 7%, but with this being such a small increase the overwhelming consensus was that the SARB would stick to a path of 25bps rate hikes just as they had done in January. It was a genuine surprise then when Governor Lesetja Kganyago said the voting committee was split 3/2 in favour of a 50bps hike, and just like that our policy tightening trajectory accelerated.

Nobody was trying to “out hawk” the market and speculate that the SARB would deliver a 50bps move and so this was nowhere near priced into the Rand. But 50bps it was, and if you look at a 1 day chart of ZAR/USD the impact is obvious as we shot from R18.03 to R17.77 in an instant, and taking the Rand to its best level in 7 weeks. The immediate question analysts are asking is does this mean that the SARB signed off with a bang and are now done hiking, or could we see local interest rates move even higher despite now sitting at a level last seen in 2009?

The US currency has come under renewed pressure, falling 2% in March, as turmoil in the banking industry led investors to scale back the likely peak in US interest rates. That takes the decline in the DXY dollar index to over 10% since the currency hit a 20-year peak in September. We believe the main pillars of US dollar strength last year aggressive tightening by the Federal Reserve and a resilient US economy are unlikely to support the currency going forward. The Fed is coming closer to the end of its tightening cycle, and markets are seeing scope for rate cuts later this year.

German headline inflation dropped in March to the lowest level since last summer. However, there are still no signs of any broader disinflationary trend outside energy and commodity prices. Has the disinflationary process started? We don’t think so. German March headline inflation came in at 7.4% Year-on-Year, from 8.7% YoY in February. The HICP measure came in at 7.8% YoY, from 9.3% in February. The sharp drop in headline inflation is mainly the result of negative base effects from energy prices, which surged in March last year when the war in Ukraine started.

The boss of an allegedly fake City of London foreign-exchange investment firm defrauded investors of £50 million ($61.7 million) after deceiving them with authentic-looking luxury offices and elite sponsorship deals at Chelsea Football Club, a court was told. Anthony Constantinou, who ran Capital World Markets Ltd. and allegedly controlled the clients’ money, is on trial accused of seven offenses between 2013 and 2015 including fraudulent trading.

Russia detained US journalist Evan Gershkovich for alleged espionage, triggering a new confrontation between Moscow and Washington. The 31-year-old Wall Street Journal reporter was arrested in the Urals by Federal Security Service agents and brought to Moscow where a district court ordered him to be held at the Lefortovo pre-trial detention center until at least May 29 during a hearing on Thursday. The case was classified as “top secret.” The newspaper denied the allegations and asked for the immediate release of “our trusted and dedicated reporter.” Gershkovich also denied the allegations.

The Competition Tribunal in SA has ruled that it has the jurisdiction to hear the long-standing case against foreign and local banks that allegedly colluded to manipulate the rand-dollar exchange rate, and has included nine more banks to the matter.

It said in a statement on Thursday that it granted Competition Commission’s applications to join the nine banks to the case that dates back nearly eight years. They include HSBC Bank USA, Merrill Lynch, Pierce Fenner and Smith, National Association, Bank of America, Credit Suisse Securities (US), Nedbank, FirstRand, as well as Standard Americas.

Nineteen other banks are already included in the case including Absa, Standard Bank, Barclays and Investec.

Several banks had objected to the tribunal hearing the matter on the grounds of lack of jurisdiction, among other issues.

Former president Donald Trump indicted by Manhattan Grand Jury. Trump is insistent that the move is politically motivated.